All Categories

Featured

Table of Contents

- – How can Whole Life For Infinite Banking reduce...

- – What are the common mistakes people make with ...

- – What are the benefits of using Generational W...

- – What happens if I stop using Infinite Wealth ...

- – What is the long-term impact of Life Insuran...

- – Can anyone benefit from Infinite Banking Vs ...

Prostock-Studio/ GOBankingRates' editorial team is dedicated to bringing you unbiased testimonials and information. We utilize data-driven techniques to examine monetary products and services - our evaluations and rankings are not affected by marketers. You can read much more about our editorial standards and our products and services assess method. Infinite banking has actually recorded the passion of lots of in the individual finance globe, guaranteeing a course to economic freedom and control.

Limitless banking refers to a financial method where an individual becomes their very own banker. The insurance holder can borrow against this money value for numerous financial requirements, properly lending cash to themselves and settling the plan on their own terms.

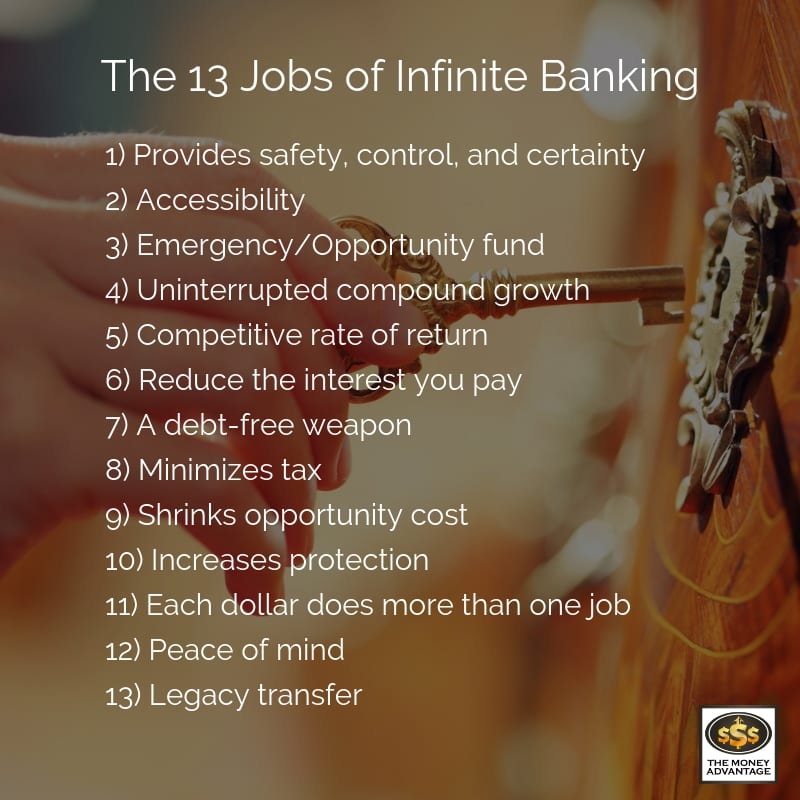

This overfunding accelerates the development of the policy's money value. The insurance holder can then obtain versus this money worth for any purpose, from financing a vehicle to purchasing realty, and then pay off the financing according to their own schedule. Limitless financial uses several benefits. Right here's a look at a few of them. Infinite wealth strategy.

How can Whole Life For Infinite Banking reduce my reliance on banks?

It involves using a whole life insurance coverage plan to develop an individual financing system. Its effectiveness depends on various elements, consisting of the plan's framework, the insurance company's efficiency and how well the method is taken care of.

It can take numerous years, typically 5-10 years or even more, for the money worth of the policy to grow adequately to start obtaining against it properly. This timeline can differ depending on the plan's terms, the costs paid and the insurance coverage firm's performance.

What are the common mistakes people make with Privatized Banking System?

Long as premiums are current, the insurance policy holder simply calls the insurance company and demands a loan versus their equity. The insurance provider on the phone will not ask what the funding will be utilized for, what the income of the customer (i.e. policyholder) is, what various other properties the person may have to function as collateral, or in what timeframe the person intends to repay the funding.

In comparison to call life insurance policy items, which cover only the recipients of the policyholder in the occasion of their death, entire life insurance coverage covers a person's entire life. When structured correctly, whole life plans generate an one-of-a-kind earnings stream that raises the equity in the policy over time. For further analysis on how this jobs (and on the pros and cons of whole life vs.

In today's world, globe driven by convenience of comfort, intake many also for granted our given's country founding principlesStarting concepts and liberty.

What are the benefits of using Generational Wealth With Infinite Banking for personal financing?

It is a concept that allows the insurance holder to take car loans on the whole life insurance plan. It should be readily available when there is a minute economic burden on the person, in which such financings may assist them cover the financial tons.

The policyholder requires to attach with the insurance firm to ask for a financing on the policy. A Whole Life insurance policy can be labelled the insurance coverage item that gives security or covers the person's life.

It begins when a private takes up a Whole Life insurance coverage plan. Such plans keep their values because of their conventional approach, and such plans never invest in market tools. Boundless banking is a concept that allows the insurance holder to take up loans on the entire life insurance coverage policy.

What happens if I stop using Infinite Wealth Strategy?

The cash money or the surrender value of the whole life insurance policy functions as collateral whenever taken lendings. Mean an individual enrolls for a Whole Life insurance policy policy with a premium-paying regard to 7 years and a plan duration of 20 years. The individual took the plan when he was 34 years of ages.

The security derives from the wholesale insurance coverage policy's money or surrender worth. These factors on either extreme of the spectrum of realities are talked about listed below: Boundless banking as a financial innovation improves cash money circulation or the liquidity account of the policyholder.

What is the long-term impact of Life Insurance Loans on my financial plan?

The insurance policy car loan can likewise be offered when the individual is jobless or dealing with wellness issues. The Whole Life insurance coverage plan preserves its total worth, and its efficiency does not connect with market performance.

In addition, one must take only such policies when one is economically well off and can manage the policies costs. Infinite financial is not a rip-off, but it is the best point most people can opt for to enhance their economic lives.

Can anyone benefit from Infinite Banking Vs Traditional Banking?

When people have infinite financial clarified to them for the very first time it appears like a magical and risk-free method to grow wealth - Infinite Banking for financial freedom. The concept of replacing the hated financial institution with borrowing from yourself makes so a lot more feeling. It does require changing the "disliked" financial institution for the "disliked" insurance business.

Of program insurance coverage firms and their agents enjoy the principle. They invented the sales pitch to market more whole life insurance.

There are two major monetary calamities built into the unlimited financial concept. I will certainly reveal these problems as we work with the math of how unlimited financial really works and just how you can do a lot far better.

Table of Contents

- – How can Whole Life For Infinite Banking reduce...

- – What are the common mistakes people make with ...

- – What are the benefits of using Generational W...

- – What happens if I stop using Infinite Wealth ...

- – What is the long-term impact of Life Insuran...

- – Can anyone benefit from Infinite Banking Vs ...

Latest Posts

Ibc Savings Account Interest Rate

Be Your Own Bank: Cash Flow Banking Is Appealing, But ...

Whole Life Concept

More

Latest Posts

Ibc Savings Account Interest Rate

Be Your Own Bank: Cash Flow Banking Is Appealing, But ...

Whole Life Concept